Automated trading systems can be a powerful tool for traders looking to improve their performance and efficiency. These systems have become increasingly popular among traders and investors, but do they really work? In this article, we will explore the benefits and drawbacks of using algo trading.

What are Automated Trading Systems?

Automated Trading Systems, also known as algo trading, are computer programs that allow traders to set specific rules for trade entries and exits. Once programmed, these rules can be executed automatically through a computer without requiring human mediation.

These systems are used for various financial instruments, such as stocks, futures, options, currencies, and cryptocurrencies. They can operate on different time frames, from high-frequency trading (HFT) that executes trades in fractions of a second, to swing trading that holds positions for several days.

How does it work?

To use an automated trading system, a trader needs to create a set of rules and conditions for the system to follow. These rules may include indicators to analyze, entry and exit points, risk management parameters, and position sizing rules.

While it is important to have a basic understanding of programming, you don’t need to be a professional programmer to use the trading robot. Most apps come with pre-programmed settings, and can be easily customized to suit your trading style.

Once the system is ready, it can be connected to a trading platform and run automatically, with trades executed according to the pre-programmed rules.

How do I build my own trading robot?

To create a basic trading system, it is helpful to have some understanding of programming concepts.

If you have experience in programming, transitioning to a new language for trading robots should be relatively easy, as the syntax is similar to that of C or Java.

Tip: If you are interested in creating a trading robot, we offer courses on how to do it yourself, or you can just use this free tool.

Nevertheless, the majority of traders who use automated trading systems do not have programming skills. Instead, they depend on robots that are programmed by other developers.

Advantages of Using Algo Trading

Time savings

The significant advantage of algorithmic trading is the time and effort they save traders. Traders can focus on other aspects of their life, while the app works tirelessly to execute trades on their behalf.

No emotions involved

In the world of trading, the ultimate goal is to make money, not lose it. However, the harsh reality is that many people end up losing their money. When the traders become too emotionally invested, they may overthink their actions. They end up overtrading, which can result in significant losses.

The robot follows a set of mechanical rules. It eliminates any emotional biases that may affect human traders. Automated trading systems not only help people who are hesitant to make trades but also can help to control those who tend to buy and sell at every opportunity.

Speed and Efficiency

One of the primary benefits of trading robots is their ability to execute trades much faster than a human trader. Algorithmic systems can monitor the markets, analyze data, and place trades in a matter of milliseconds. It can be critical in fast-moving markets, where a few seconds can make a big difference.

24/7 Trading

Automated trading systems can operate around the clock, even when the trader is not actively monitoring the markets. It allows traders to take advantage of opportunities that may arise during off-hours, such as news events or market movements in other time zones.

Consistency

To become a successful trader, it is crucial to have strong discipline and to follow the golden rule of “Plan the trade, then trade the plan”. Automated trading systems come in handy in this regard. Even if a trading plan has the potential to be profitable, deviating from the rules can significantly impact the system’s profitability. No trading plan can guarantee a 100% win rate, and losses are inevitable.

However, if the trader skips the next trade after having two or three consecutive losing trades, it will ruin any expectancy the system had. With the help of the trading robot, traders can maintain consistency by sticking to their trading plan, thus maximizing their chances of success.

Backtesting

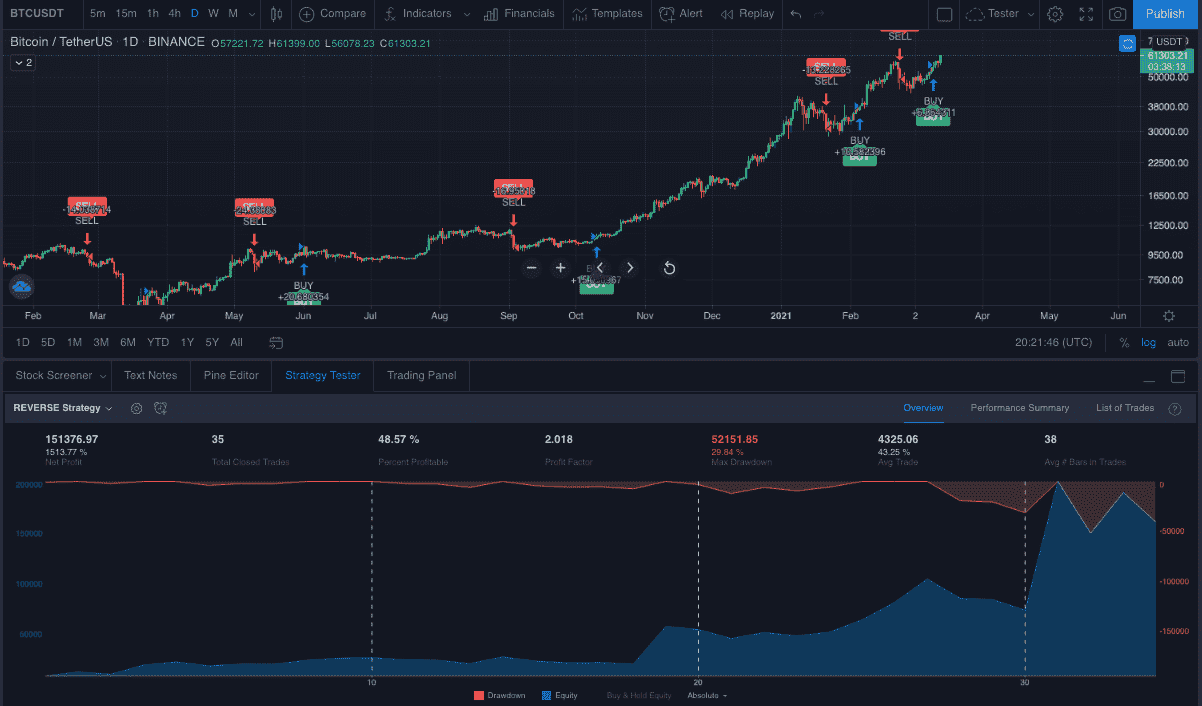

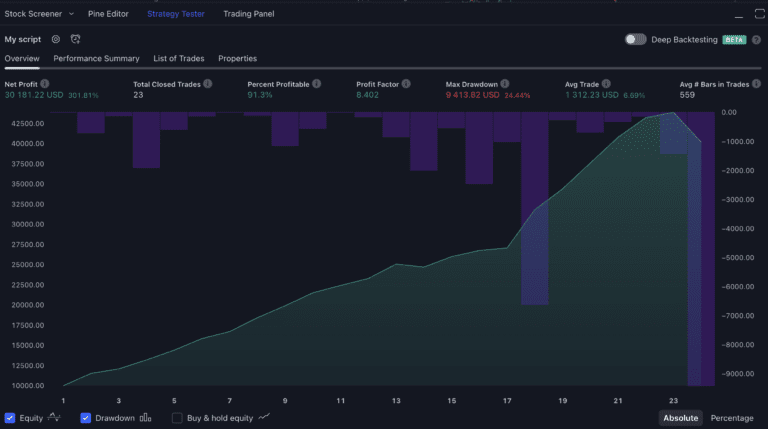

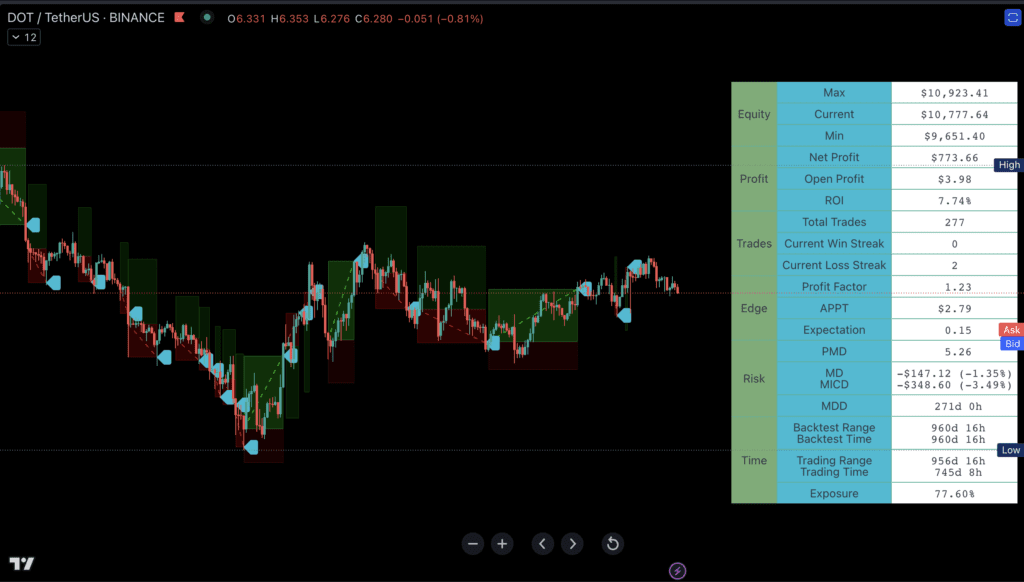

One of the notable advantages of mechanical trading systems is that they can be backtested using historical data. This feature allows traders to evaluate how the system would have performed in the past.

It can help refine the trading rules before the trader starts trading on the real-time market, and reduce the risk of losing money due to guesswork.

Diversification

Automated trading systems can trade multiple accounts and strategies concurrently, which can help spread risk across different asset classes and markets. Diversification helps to mitigate the impact of market volatility and minimize the risk of losses.

Disadvantages of Using Automated Trading Systems

While there are many advantages to using automated trading apps, it is important to note that they also have their limitations.

Markets are unpredictable

Markets are known to be highly unpredictable and prone to sudden changes. This makes trading environments challenging to navigate. Unexpected news or a shift in market trends can disrupt the trading robots and lead to inaccurate trade signals.

One solution to this issue is to use multiple trading apps that are specifically programmed for different market environments. However, mechanical trading rules cannot guarantee success at all times.

That’s why you have to backtest a trading robot on a demo account and in different market conditions. Backtesting allows traders to identify the weaknesses in the algorithm before risking real money in the live market.

Risk management

Trading robots operate solely based on pre-determined rules and algorithms. They will automatically execute trades whenever the conditions for their algorithms are met. However, experienced traders may have a gut feeling that something is not right with the trade, and avoid entering it.

Unlike humans, trading robots do not possess any common sense or intuition. They cannot account for market sentiment or other external factors that may affect the market. They will continue to execute trades, even when conditions in the market have shifted unfavorably, potentially leading to losses.

Technical Complexity

One of the main challenges of using automated trading systems is their technical complexity. These apps require technical expertise to set up and maintain, including programming skills and knowledge of trading platforms and data feeds. It can be a barrier to entry for some traders, especially beginners.

Over-Optimization

Another challenge with automated trading systems is the risk of over-optimization. It is possible to fine-tune a robot to historical data to the point where it becomes too specific and loses its ability to perform well in live trading. Over-optimization can also lead to curve-fitting, where the system is too closely tailored to historical data and is not robust enough to handle market changes.

Lack of Flexibility

Trading robots may not adapt to changing market conditions or unexpected events. This lack of flexibility can lead to missed opportunities or losses.

Cost

The cost of an automated trading system does not always determine its performance. As a novice trader, you may have come across numerous trading robots. Some are free while others require payment, which can be expensive to develop and maintain, especially for individual traders.

Automated trading apps are not immune to scams. It is essential to backtest its performance before using it on a live account.

Technical Issues

Mechanical trading systems can experience technical issues, such as connectivity problems or data feed errors. It can result in missed trades or other issues. These problems can be difficult to diagnose and resolve.

Should I use Automated Trading Systems?

In conclusion, trading robots are valuable tools for traders, but they should be used in conjunction with human intuition and market knowledge. Traders should not solely rely on their trading robot, as programs do not possess the common sense that is often necessary for the ever-changing market environment.

For individual traders who are disciplined, and are willing to take on higher risk, trying their hand at algo trading can be a good option.

Trading systems can offer many benefits, including speed, efficiency, and consistency. However, they also have their downsides, such as technical complexity, lack of flexibility, and the potential for over-optimization.

Traders should carefully consider the advantages and disadvantages of automated trading systems before they jump into algo trading. Moreover, they should constantly monitor their robot’s performance and adjust its rules and parameters.

If you are interested in developing an automated trading system there are lots of platforms out there that can help. TradingView is the main platform we use here because they make it easy. In fact, you can build an automated trading system today by just using this free tool. Try it out and see if this is a path you want to discover!