In this blog post, we will explore some tips on how to get the best strategy results with the PSStrategyX tool.

Understand the PSStrategyX Tool

To get the most out of the PSStrategyX tool, it’s essential to have a good understanding of how it works. The tool simplifies the process of connecting Pine Script strategies to third-party exchanges by configuring the correct alert syntax automatically. This means that traders can live trade their strategies with minimal setup, saving time and effort. For a more in depth understanding you can check out the Docs

Backtest and Forward Test Your Strategy

Before live trading your strategy, it’s crucial to backtest and forward test it to ensure that it performs as expected. The PSStrategyX tool allows you to do both easily. Backtesting allows you to apply your strategy to historical data to see how it would have performed in the past. Forward testing, on the other hand, involves testing your strategy in real-time with small amounts of capital to verify that it works as expected.

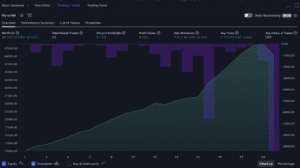

As a trader, the variables you should focus on depend on your risk tolerance, trading style, and overall strategy. However, the Strategy Summary contains some key variables that are generally important for traders seeking high returns:

- Net Profit: This represents the total amount of money you’ve made after deducting trading costs and losses. This is the most straightforward way to measure your trading success.

- Return on Investment (ROI): This represents the percentage return on your investment. It is calculated by dividing your net profit by the total amount of money you have invested. A high ROI indicates that your strategy is generating strong returns relative to the amount of capital you have invested.

- Profit Factor: This is the ratio of your gross profits to your gross losses. A profit factor greater than 1 indicates that your strategy is profitable.

- APPT (Average Profit per Trade): This represents the average profit per trade. A high APPT means that your strategy is generating strong profits on average.

- Expectancy: This measures the average amount of money you can expect to win or lose per trade. A positive expectancy indicates that your strategy is profitable.

- Max Drawdown: This represents the maximum amount of money you’ve lost at any point in your trading history. It is important to keep this number as low as possible, as a high drawdown can not only wipe out your account and make it difficult to recover, but if you can’t stomach the losses then you will likely stop using the strategy before it can succeed. So make sure to ask yourself if you are comfortable losing x amount of money.

- Max Drawdown Duration: This represents the length of time it took to recover from your maximum drawdown. The shorter this period, the better, as it means you can get back to profitability faster. If this number is big, just ask yourself if you are willing to wait that amount of time before reaching a new high in your strategy, if not, tweak it until you are.

Ultimately, it is important to remember that trading is not a get-rich-quick scheme and that there are no guarantees of success. It is important to develop a sound trading strategy and focus on risk management to minimize losses and maximize profits.

Tweak The Tool

There are several ways to tweak the PSStrategyX tool to produce better strategy results. Here are some tips to help you optimize your trading strategy:

- Experiment with different date filters: By tweaking the date filter settings, you can test your strategy on different market conditions, which can help you identify the best times to trade. For example, you may want to test your strategy during high volatility periods, or during certain months or seasons when the market tends to perform well.

- Use the day of the week filter: The day of the week filter can be used to identify patterns in the market based on the day of the week. For example, you may want to test your strategy on Mondays or Fridays when the market tends to be more volatile.

- Use the session filter: The session filter can be used to test your strategy during specific trading sessions. For example, you may want to test your strategy during the London or New York trading sessions when the market is most active.

- Experiment with different entry stops and take profit settings: The PSStrategyX tool allows you to set your entry stops and take profits using different methods. Experimenting with different settings can help you find the best combination for your strategy.

- Use the trade summary to analyze your trading performance: The trade summary provides you with detailed statistics for each trade, including the entry and exit prices, profit and loss, and more. This can help you identify areas where you need to improve your trading strategy.

- Use the strategy summary to analyze your overall trading performance: The strategy summary provides you with various metrics of your entire strategy after being backtested on historical data. This can help you identify the strengths and weaknesses of your strategy and make improvements accordingly.

- Continuously improve the PSStrategyX: As with any tool, there is always room for improvement. Providing feedback to the PSStrategyX developers can help them make the necessary improvements to the tool, which can ultimately improve your trading results.

In conclusion, tweaking the PSStrategyX tool and helping to improve it can help you optimize your trading strategy and produce better results. By experimenting with different settings and analyzing your trading performance, you can identify areas where you need to improve and make the necessary adjustments to your strategy.

Use Risk Management Techniques

Risk management is crucial in trading, and it’s equally important when using the PSStrategyX tool. You need to manage your trades in a way that minimizes your losses and maximizes your profits. One way to do this is to use stop-loss orders. A stop-loss order is an order that automatically closes a trade when a specified price is reached. This can help you to limit your losses and protect your capital.

The PSStrategyX tool comes with built in stop-loss orders ready to go. You can even set your take profit based on how much you risk.

Keep a Trading Journal

Keeping a trading journal is always a good idea, regardless of the tool you’re using. It allows you to monitor your progress and learn from your mistakes. With the PSStrategyX tool, you can record your trades, including the entry and exit points, the size of the position, and the reasoning behind the trade. This can help you to identify patterns in your trading and make necessary adjustments to your strategy.

Since most of the trades are automated there won’t be much for you to journal. However, if you find yourself itching to tweak a setting or turn off your strategy make a note of how your feeling and why you want to take action. If it makes sense, go for it. If your confused, let the strategy continue to trade and trust that it will work.

How do you know when the strategy is no longer performing the same as it was historically?

When you decide on a strategy after your done testing. Be sure to make a note in your trading journal of the specific values in the Strategy Summary table. Taking a screenshot will be easiest. Just don’t forget about the extra values when hovering over a cell.

You’ll want to pay specific attention to “loss streaks” and “Maximum Drawdown” as these two will affect your psyche the most and make you want to turn off the auto trader when it is not performing well.

Since you already backtested it, you have an idea of how it performs, so check out your maximum loss streak. Have you exceeded that value? If so, something might have changed. Same thing goes for the Maximum Drawdown.

Pretty soon we will upgrade the PSStrategyX tool so it will automatically monitor these values for you and turn off the Autotrader if things get out of whack!

Stay Disciplined

Finally, it’s essential to stay disciplined when using the PSStrategyX tool. It’s crucial to stick to your strategy and avoid emotional trading decisions. Emotional trading can lead to impulsive decisions that can result in significant losses. It’s essential to have a clear trading plan and to follow it consistently. Set rules for yourself to turn off the autotrader only on certain conditions before you start so you can make objective decisions.

Summary

In conclusion, the PSStrategyX tool is an excellent tool for traders who use Pine Script on TradingView. By understanding the tool, backtesting and forward testing your strategy, tweaking the settings, using risk management techniques, keeping a trading journal, and staying disciplined, you can get the best strategy results. Remember, trading is a journey, and it takes time and effort to achieve consistent profits.

Get the PSStrategyX tool

If you’re a trader who uses Pine Script on TradingView, you might be familiar with the limitations of integrating Pine Script with exchanges through TradingView. This can make it challenging to live trade your Pine Script strategies with real money. However, the PSStrategyX tool was developed to address these limitations and help traders automate their trading strategies with minimal setup. Get it here now.