Pine Script is TradingView‘s programming language for creating custom indicators and automated trading strategies. Whether you’re new to coding or an experienced trader, this guide will help you write your first Pine Script strategy. Here’s what you’ll learn:

- What is Pine Script? A beginner-friendly language for building technical analysis tools.

- Why use it? It’s easy to learn, runs on TradingView’s cloud, and comes with robust backtesting tools.

- How to start: Set up a free TradingView account, access the Pine Editor, and customize your workspace.

- Core concepts: Learn key elements like variables, functions, and strategy parameters.

- Build your first strategy: Create a moving average crossover strategy with entry/exit rules, risk management, and backtesting.

- Test and optimize: Backtest your strategy, analyze performance metrics, and refine settings.

- Go live: Set alerts, manage risks, and prepare for live trading.

Pine Script Tutorial | Developing Real Trading Strategies On …

TradingView Setup Guide

Follow these steps to set up TradingView for Pine Script. You’ll learn how to configure your account, customize your workspace, and dive into the Pine Editor.

Account Setup Steps

Getting started with TradingView is simple:

-

Create Your Account

Sign up for a free TradingView account. While premium options are available, the free account includes all the tools you need to begin writing and testing Pine Script strategies. -

Configure Your Workspace

Adjust your chart layout and timeframes to suit your strategy testing needs. -

Access the Pine Editor

Open the "Pine Editor" tab located at the bottom of the TradingView platform. The editor offers two modes for coding:Editor Mode Best For Features Default View Quick edits and testing Integrated directly with the chart Separate Window Extended coding sessions Larger workspace with focused coding

Now, let’s explore the basics of the Pine Editor.

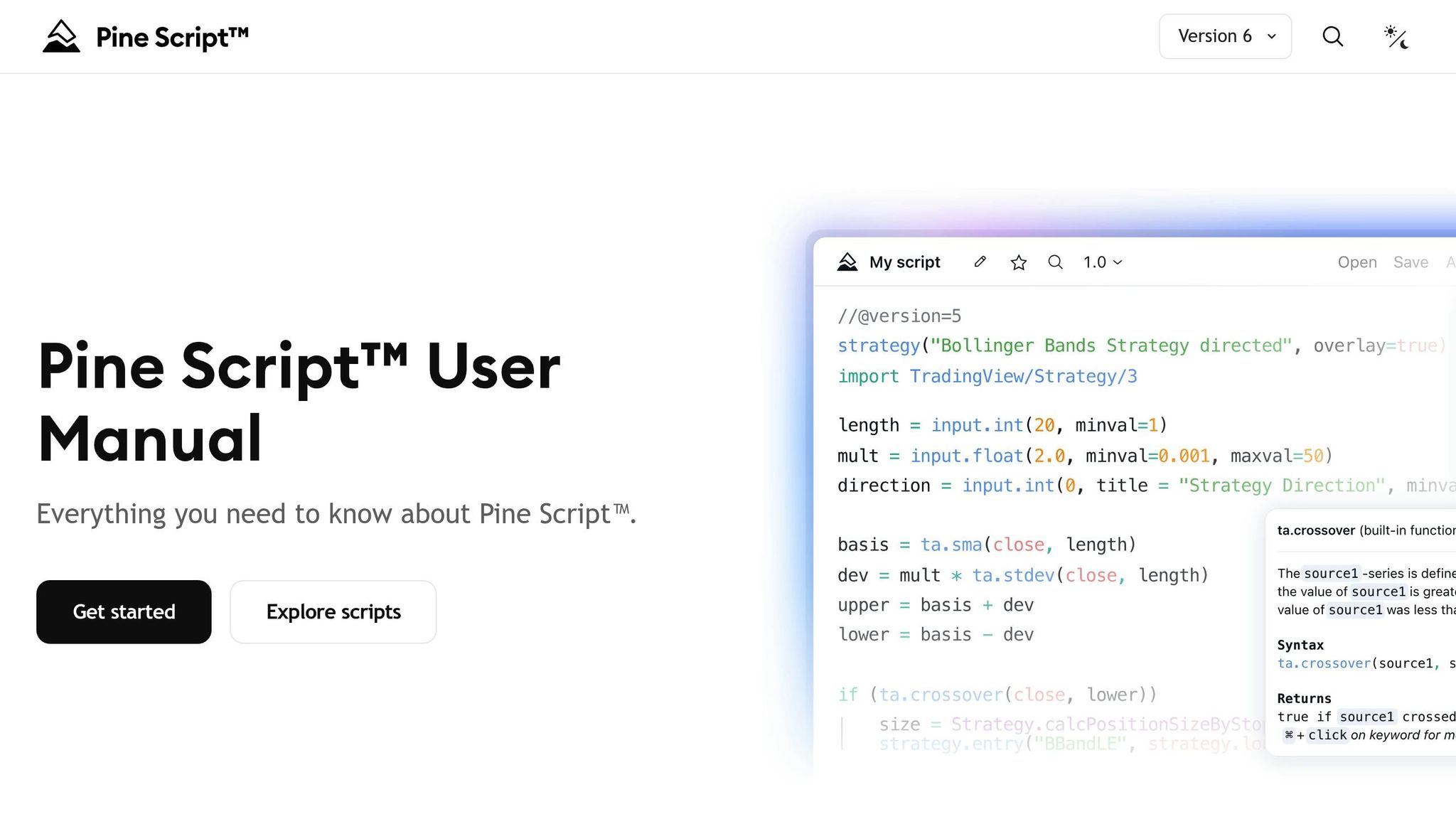

Pine Editor Basics

The Pine Editor is user-friendly and packed with helpful tools.

Creating New Scripts:

To start a new strategy, click "Open" in the top-right corner of the Pine Editor and choose "New strategy" from the templates menu. This will load a default strategy template to get you started.

Key Features of the Editor:

The Pine Editor includes tools like:

- Syntax highlighting for easier reading

- Auto-completion to speed up coding

- A built-in library of functions

- Real-time error checking for debugging

Its syntax is similar to C++ or JavaScript, making it approachable for those familiar with coding.

Managing Scripts:

Here are a few points to keep in mind when working with scripts:

- The editor automatically saves and reopens your last script.

- To edit a script, create a copy first.

- Any changes you make to built-in scripts remain private to your account.

For more complex projects, you can expand the Pine Editor into a separate window by clicking the "More" button (three dots) at the top of the editor. This gives you additional space to work on detailed strategies.

Pro Tip: If you’re using the separate window, remember that some features – like adding new indicators to charts or publishing scripts – aren’t available in this mode. Switch back to the main interface for these actions.

Pine Script Core Concepts

Basic Programming Elements

Pine Script is built around functions and variables. Functions handle processing tasks, while variables store the data needed for calculations.

Variables in Pine Script can hold numbers, conditions, or series data. They follow specific naming conventions: variables use camelCase while constants are written in SNAKE_CASE.

Here’s a quick breakdown of common variable types in Pine Script:

| Variable Type | Purpose | Example Declaration |

|---|---|---|

| Series | Tracks data across bars | float fastMA = ta.sma(close, 10) |

| Simple | Stores a single value | int period = 14 |

| Constants | Holds fixed values | string STRATEGY_NAME = "MA Cross" |

Function Structure: Every Pine Script strategy starts with the //@version=6 directive, followed by the strategy() declaration. This sets up the framework for your trading logic.

Strategy Function Guide

The strategy() function is where you define your strategy’s parameters and simulation settings.

Key Parameters for Strategies:

| Parameter | Purpose | Example Value |

|---|---|---|

title |

Name of the strategy | "Simple MA Crossover" |

overlay |

Determines chart overlay | true or false |

initial_capital |

Starting capital for testing | 10000 |

default_qty_type |

Position sizing method | strategy.percent_of_equity |

default_qty_value |

Value for position sizing | 100 |

How It Works: Pine Script processes each historical bar one at a time and updates calculations with every price or volume change.

Helpful Tips:

- Always specify variable types for better readability.

- Follow a consistent script structure: version declaration, strategy setup, inputs, calculations, and trading logic.

- Use proper spacing around operators for clean code.

- Keep your script modular to make it easier to manage and adjust.

Pine Script operates on a series-based system, meaning calculations generate a new series of values across all bars. With these basics, you can start building and fine-tuning your own trading strategies.

sbb-itb-ad8e259

Creating Your Strategy

Setting Strategy Rules

To create a basic trading strategy in Pine Script, start by defining your strategy parameters. Use the input() function to make it easy to customize your strategy without altering the code:

//@version=6

strategy("MA Crossover Strategy", overlay=true)

// Input parameters

fastLength = input.int(10, "Fast MA Length", minval=1)

slowLength = input.int(20, "Slow MA Length", minval=1)

riskPercent = input.float(2.0, "Risk Per Trade %", minval=0.1, maxval=100)

These inputs allow you to fine-tune your strategy’s settings during testing, making adjustments simple and efficient.

Trade Entry and Exit Rules

Here’s how to implement a moving average crossover strategy for your trade entry and exit conditions:

float fastMA = ta.sma(close, fastLength)

float slowMA = ta.sma(close, slowLength)

// Entry conditions

if ta.crossover(fastMA, slowMA)

strategy.entry("Long", strategy.long)

if ta.crossunder(fastMA, slowMA)

strategy.entry("Short", strategy.short)

To manage risk effectively, include exit orders as shown in the table below:

| Order Type | Function | Purpose |

|---|---|---|

| Stop Loss | strategy.exit() |

Limits potential losses |

| Take Profit | strategy.exit() |

Locks in profits |

| Trailing Stop | strategy.exit() |

Protects gains dynamically |

With these in place, you can focus on refining your position sizing for better risk control.

Position Size Settings

Once your entry and exit rules are set, configure your position size to match your risk preferences. Here are a few common methods:

- Percentage of Equity: Allocate a portion of your account balance for each trade.

- Fixed Position Size: Trade a set number of contracts or shares.

- Risk-Based Sizing: Calculate position size based on your stop-loss level.

"Risk management is the cornerstone of successful trading, and it’s often the difference between turning a profit and suffering a loss." – Harrocop

For example, if you’re using a 4% stop-loss, setting a MarginFactor of -0.5 means you’re risking 2% of your capital on each trade. This ensures your risk stays controlled while allowing for steady growth.

Strategy Testing Methods

Once you’ve built your strategy, the next step is to test it thoroughly to ensure it performs as expected.

Backtest Process

Backtesting allows you to see how your strategy would have performed using historical data. TradingView provides built-in tools to make this process easier.

//@version=6

strategy("MA Crossover Backtest", overlay=true, initial_capital=10000)

You can access the Strategy Tester tab at the bottom of your TradingView chart to analyze your strategy’s performance automatically.

| Testing Component | Description | Key Consideration |

|---|---|---|

| Initial Capital | Starting account balance | Match it to your actual trading funds |

| Date Range | Historical period for testing | Cover multiple market conditions |

| Commission | Trading fees per transaction | Account for your broker’s fee structure |

| Slippage | Difference in price execution | Reflect market liquidity and volatility |

Performance Review

Once you’ve backtested, focus on these metrics to evaluate your strategy:

- Net Profit: Your total earnings after subtracting costs.

- Profit Factor: The ratio of gross profit to gross loss. Aim for a value higher than 2.0.

- Win Ratio: The percentage of trades that were profitable.

- Maximum Drawdown: The largest drop from a peak to a trough in your equity.

"Evaluating trading performance is essential for investors seeking long-term success in the financial markets." – PineConnector

Make sure your strategy aligns with your overall risk tolerance and trading goals.

Parameter Adjustment

Use the insights from your backtest to tweak and improve your strategy:

- Moving Average Periods: Experiment with different periods to find the optimal settings.

- Position Sizing: Adjust based on your account size and how much risk you’re comfortable taking.

- Stop Loss and Take Profit: Test various levels for stop loss, take profit, and trailing stops to strike the right balance.

Make incremental changes to your parameters and assess how each adjustment impacts performance. This step-by-step process will help you refine your strategy for better results.

Strategy Implementation

Put your tested strategy into action in live markets with accurate configuration.

Setting Trade Alerts

Set up trade alerts to respond to key signals right away:

//@version=6

strategy("MA Crossover Alert", overlay=true)

// Add alert conditions to your strategy

alertcondition(crossover, "Buy Signal", "Price crossed above MA")

alertcondition(crossunder, "Sell Signal", "Price crossed below MA")

| Alert Component | Configuration | Purpose |

|---|---|---|

| Trigger Condition | Signal-based | Runs when strategy conditions are met |

| Notification Type | Email/SMS/Push | Select your preferred alert delivery method |

| Message Template | Dynamic placeholders | Add trade details like price and position size |

| Expiration | Custom duration | Set how long the alert remains active |

"When an alert is created for a strategy, a copy of the strategy is created on our servers. This copy then runs independently from the chart’s strategy in your browser, and changes to your chart’s strategy will have no effect on the operation of its copy running on our servers." – TradingView

Sharing Your Strategy

Document your strategy and publish it privately for initial feedback. Use these visibility settings based on your needs:

| Visibility Type | Access Level | Best For |

|---|---|---|

| Open-source | Public code access | Community learning and collaboration |

| Protected | Closed source | Proprietary strategies |

| Invite-only | Limited access | Premium or custom strategies |

When publishing, include a clear description, setup instructions, performance expectations, and risk management details.

Once your strategy is documented and shared, proceed to configure it for live trading.

Live Trading Guidelines

After verification and sharing, follow these steps to prepare for live trading:

-

Time Zone Configuration

Align your strategy’s time zone with your trading market to ensure signals are timed correctly. -

Risk Management Settings

Limit risk to 2% per trade using this setup:strategy("Risk-Managed Strategy", initial_capital=10000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=2) -

Order Execution Parameters

Enableprocess_orders_on_close=truein your strategy to ensure orders execute at the bar’s close.

Track your progress by exporting strategy results and keeping detailed trading logs to monitor live performance effectively.

Summary and Future Steps

Main Points Review

Creating your first Pine Script strategy involves mastering several key components and following effective practices. The strategy() function is at the core, allowing you to simulate trades and analyze performance using the strategy.* namespace. Here’s a breakdown of the essentials:

| Component | Key Considerations | Impact |

|---|---|---|

| Order Management | Entry/Exit rules, position sizing | Ensures accurate execution and trade control |

| Risk Management | Strategy parameters | Protects your capital |

| Testing Methods | Backtesting and forward testing | Confirms the strategy’s effectiveness |

"Pine Script™ Strategies are specialized scripts that simulate trades across historical and realtime bars."

These elements provide a solid foundation for further development and refinement of your trading strategies.

Learning Path

Once you’ve established a basic strategy, you can expand your skills through these focused steps:

- Foundation Building: Start with the Pine v4 Quickstart Guide. Experiment with code examples, make modifications, and use plot statements to debug and understand your scripts.

-

Advanced Development: Add more complex features to your strategies, such as:

Feature Purpose Implementation Trading Costs Simulate realistic performance Include commission and slippage Risk Management Safeguard your capital Introduce robust risk control measures Multi-level Exits Create nuanced exit strategies Combine take-profit levels with trailing stops - Community Engagement: Join platforms like TradingView and PineCoders to get real-time feedback and advice from experienced developers.

For continuous growth, regularly check the PineCoders FAQ & Code resource and explore open-source indicators from seasoned Pine Script developers on TradingView. This hands-on approach will help you craft more advanced strategies while keeping risk management a priority.