Introduction

The main focus of this article is to help you understand what automated trading is, why you might need it and what options are out there.

Automated trading is the ability to have a computer take trades for you. It doesn’t have to be 100% automated, you can utilize the computer to alert you of potential setups and then check on it your self, or you can have a computer fully take the trade for you. The best part, it’s easy to do and you don’t have be a genius or work for a hedge fund to learn.

Here’s how automated trading can help you:

- No Mood Swings: Computers don’t get scared or greedy, so they don’t make trades based on emotions like humans do. This is why I learned how to automate my trades.

- Speed: Have you ever tried to trade the news, or maybe take advantage of an arbitrage opportunity only to find that you are just too slow? Well, that’s because you are trading against computers.

- 24/7 Trading: Computers can work all day and night without getting tired. They crushed Paul Bunyan in the railroad days, and you’re not Paul Bunyan. When you’re sleeping tonight, guess who’s still trading the London, Asia, and New York with the same veracity.

- Practice Makes Perfect: The best part about automating your system is you can see how well it performed on historical data. Now you can KNOW if your system sucks or you just lack discipline.

- Plan Your Trade Trade Your Plan: Discipline is the ultimate maxim in trading success, who can trade your plan better than a machine?

- Lots of Things at Once: Got more than one plan? Test them all in a days work, and then trade them all. All while you are sleeping.

- No Silly Mistakes: Fat fingers? Not with computers. Eliminate human errors and emotions in trading decisions

Honestly, if you’re not automating at least part of your trading system by now, you are falling behind. You don’t have to become a quant overnight, you just need to take a small part of what you do and get a computer to do it and then you are automating your trading! It’s easy and I am going to show you how.

Types of Auto Trading Softwares

Auto trading is a pretty generic term, so let me break it down for you.

Full Auto Trading System

This system is set and forget. Well, mostly, no system is fully passive as there will always be maintenance. However this is the one that does all the trading for you, while you sit back and watch your account grow. This is the hardest to set up, but worth it.

Man In The Middle System

This system is the one I like to use most of the time. It’s similar to the Full Auto Trading System, except many of the most important decisions are left for a human. Alerts generally take the place of auto executed trades and its up to the Human to choose whether to execute the trade or not. The downside to this is that it still requires your time, and you can introduce human mistakes. So make sure you’ve got a good grasp of trading if you choose this style.

Copy Trading System

This system is similar to the Full Auto Trading System, except that your trades are just copying someone else. This is the easiest one to set up. Make sure you look for 1-2 years of historical performance on an account before subscribing your money. Things like win rate and profit don’t matter when checking historical performance. You want your account to grow sure, but you also don’t want it to disappear in one trade, and that can happen with the wrong trader. Make sure the historical performance has a low drawdown and a steady profit over time.

Getting Started with Automated Trading Software

Before you get started with any type of Automated Trading Software you will need to:

- Develop or acquire trading strategies to automate.

- Implement risk management measures.

- Research and choose a suitable platform.

- Understand basic programming concepts, especially if using platforms with scripting capabilities like Pine Script.

This article assumes you have covered steps 1 and 2 and are in the process of steps 3 and 4.

Overview of Popular Auto Trading Software Tools

There are lots of Autotrading tools out there, and if none of them are a good fit for you, you can always make one yourself! Though I’d recommend not going this route, unless you really want to understand how things work and have a half a year to invest.

Below is a list of popular Autotrading tools. Some of these are free, some are paid, some are a mix depending on the features you want. Some allow all types of Autotrading (HITM, Full Auto, Copy Trading). So it’s up to you to learn about each one and figure out which one is best for you. I will give you my recommendation though!

- Metatrader – This one is free, you can do all types of trading here. It’s the first platform I learned how to trade on.

- TradeStation – I don’t use this, but it seems quite popular for people.

- TradingView – My go to platform since 2017, beautiful charts and getting more powerful everyday.

- Oanda – Oanda uses Metatrader as its platform.

- There are lots of other platforms out there, but I’m a firm believer in TradingView. Perhaps, I will elaborate in another article the pros and cons of AutoTrading Software in a more comprehensive list. Do note, that all these listed above are closed source. If you are looking to roll your own, you don’t have to start from scratch. Just take a look here.

Understanding Pine Script

Pine Script is a Domain Specific Language (DSL) designed for the TradingView Platform. It is dynamically typed, very powerful and easy to use. Unless you decide to build your own Autobot from Javascript, Python, C or many of the other general languages then you will need to learn a DSL in order to build a trading bot.

The upside to learning a DSL over a general programming language is that it will be much quicker, and easier to implement what you need. This is why I am recommended Pine Script. In the end you will save time and see results quicker. Trust me, because I have gone both routes.

Pine Script allows anyone on the TradingView platform to create custom technical indicators and strategies. It’s free, and its easy. Just look at how easy it is to set up a moving average strategy with confluence from RSI.

//@version=5

indicator("My script")

sma20 = ta.sma(close, 20)

sma200 = ta.sma(close, 200)

rsi = ta.rsi(close, 14)

buyCondition = sma20 < sma200 and close < sma200 and rsi < 30

plotshape(buyCondition, size = size.small)Right now this is just an indicator, but we want we can turn this into a strategy so that we can backtest the signals on historical data.

//@version=5

strategy("My script") // <-- I also changed "indicator" to "strategy"

sma20 = ta.sma(close, 20)

sma200 = ta.sma(close, 200)

rsi = ta.rsi(close, 14)

buyCondition = sma20 < sma200 and close < sma200 and rsi < 30

if buyCondition

strategy.entry('Long', strategy.long)

if rsi > 80

strategy.close('Long')Notice I added an exit condition if rsi > 80. This way we can close the trade, otherwise we will never make any trades!

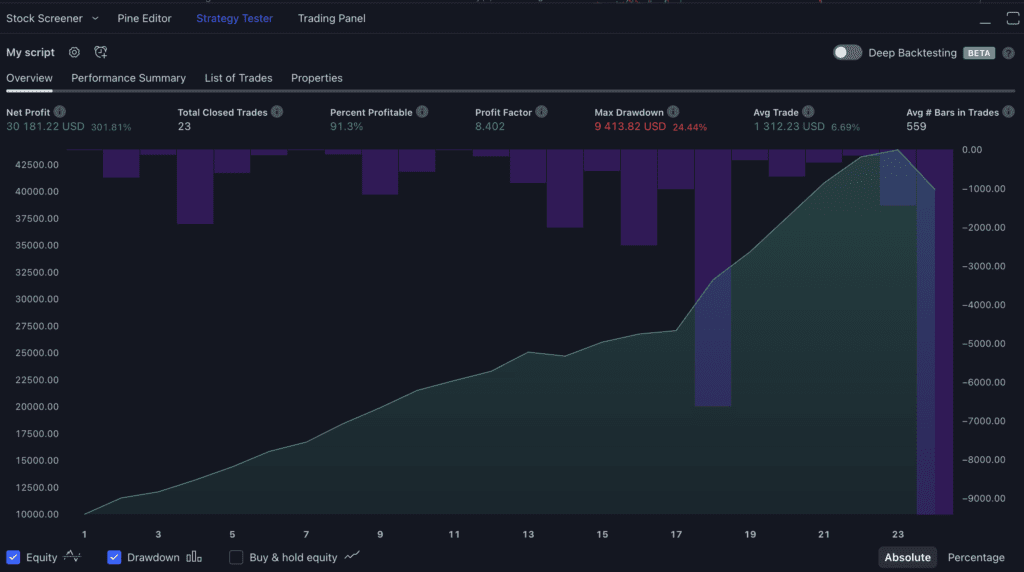

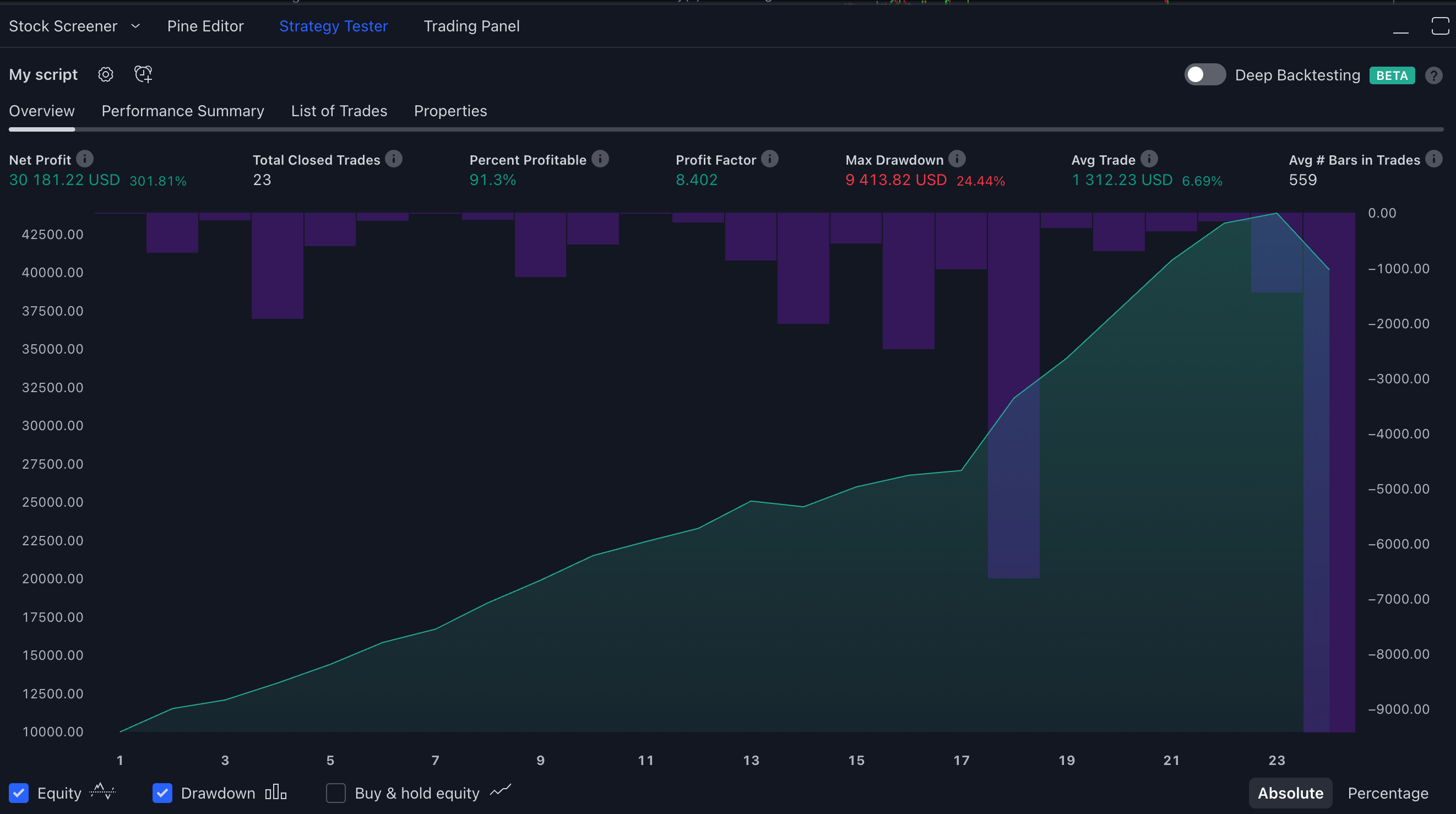

Not bad results for a strategy I just made up in just 10 lines of code!

The Rise of Robotic Trading

Today more and more people are learning how to make money from home using auto trading software. As the tech becomes easier to learn, the bar to entry get lower, and perhaps the money to be made in the markets disappears. But I don’t agree with that last part, I think with more people involved in the markets, it will be even easier to be profitable. As long as you stay ahead of the curve and learn now while the bar is still high enough, then you will have the edge you need when the time comes.

At some point AI and machine learning will make it very easy for anyone to set up Auto Bot Trading. Right now that’s still not possible, and while ChatGPT can help you write Pine Script, it doesn’t correctly write the code for you. So you need to learn. But this is good, because of the last point. Get ahead of the curve and position yourself

If you want to stay up to date on the latest automated trading advancements in Pine Script, make sure to subscribe to my Pine Script Newsletter.

Conclusion

In conclusion, automated trading is a powerful tool that can significantly enhance your trading experience. By letting computers take the reins, you can eliminate emotional biases, ensure lightning-fast execution, and trade around the clock. Moreover, automated trading allows you to rigorously test your strategies against historical data and maintain strict discipline in your trading plan.

We’ve explored three main types of automated trading systems: full auto trading, man in the middle trading, and copy trading. Each has its own advantages and considerations, so you can choose the one that best aligns with your preferences and expertise.

To embark on your automated trading journey, you need to develop or acquire trading strategies, implement robust risk management, and select a suitable platform. While there are various auto trading software tools available, we recommend considering platforms like MetaTrader, TradeStation, TradingView, and Oanda, depending on your specific needs and preferences.

In this article, we’ve also introduced you to Pine Script, a dynamic and user-friendly domain-specific language (DSL) designed for the TradingView platform. Pine Script enables you to create custom technical indicators and strategies swiftly, making it a valuable tool for those looking to automate their trading.

As the world of robotic trading continues to evolve, more and more individuals are discovering the potential to generate income from the comfort of their homes. While the technology becomes more accessible, it’s essential to stay ahead of the curve by learning and honing your automated trading skills. The rise of AI and machine learning promises exciting opportunities for future traders, and by investing in your knowledge now, you can position yourself for success when the time comes.

For more in-depth insights and recommendations on the best automated trading platforms tailored to your specific investment goals, stay tuned for our upcoming blog post. Subscribe to our Pine Script Newsletter to ensure you stay up-to-date with the latest advancements in the world of automated trading. With dedication and the right tools, you can harness the power of automation to take your trading endeavors to new heights.

[…] Script is TradingView‘s programming language for creating custom indicators and automated trading strategies. Whether you’re new to coding or an experienced trader, this guide will help you write your […]